Introduction

Fintech is a trending technology that has skyrocketed in the 21st century. Its market size was $110.57 billion in 2020 and may reach $698.48 billion by 2030, growing at a CAGR of 20.3% from 2021 to 2030. Many banks have adopted fintech apps in the banking industry to replace the traditional banking system and procedure. For example, 60% of credit unions and 49% of banks in the United States find establishing a partnership with a fintech service essential.

However, creating an app is complex work. It requires investment in money and human resources. Some companies will build an in-house team for development, or they will outsource a software service. No matter what way you use, you need to have a solid understanding of the fintech app before you start work on it. In this article, we would like to share how to develop fintech app in the banking industry.

Type of fintech apps in the banking industry

There are several areas in the banking system. A bank will start building depending on specific needs. Here are some types of fintech apps that you can choose from.

1. Digital Banking App

Digital banking app allows customers to carry out traditional banking activities online, such as opening a new account, transferring and receiving money, tracking balance, and getting news notification.

2. Payment App / Digital Wallet

Customers can do online P2P transactions, online and offline purchases via a payment app. They must install the application on their mobile devices and link it to a banking account or credit card. Users can make payments at high speed and super convenient. With all the benefits, payment app has been growing significantly, replacing physical cash. On the market, the most famous one is inarguably Paypal.

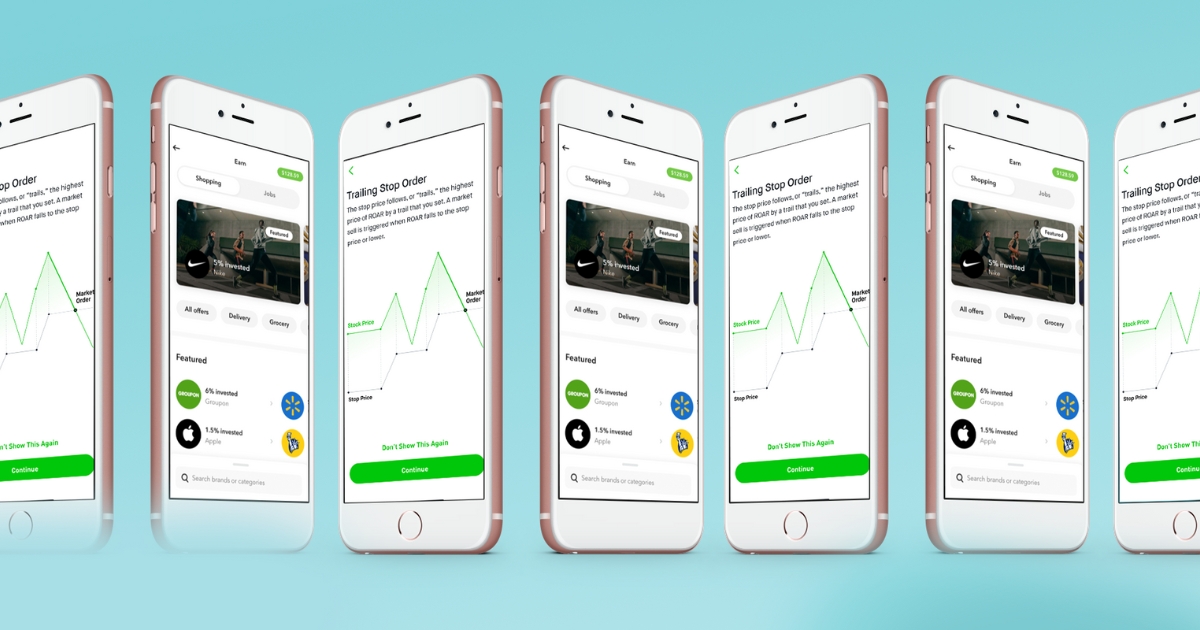

3. Investment and Trading App

The investment and trading app is for buying and selling financial assets such as stocks and cryptocurrencies. The app will integrate real-time updates and analysis of current market status for users to make informed decisions. It also features helpful user tools like price alerts, trading history, and portfolio management. You can check out apps from Coinbase, Fidelity, and Acorns for some references.

4. Personal finance management app

With this app, individuals can track and manage daily basis spending, income, and budget plans. It’s a valuable tool for those trying to save money and improve their finances.

5. Crowdfunding App

A crowdfunding app is a digital platform that helps startups, entrepreneurs, and individuals to seek an investor for their business. It often has features that allow users to market their project or business and reach a wider audience. They may also offer tools for tracking donations or investments, managing rewards, and communicating with investors or donors.

6. Online Lending App

The app allows users to apply for a loan and receive funds in their connected bank account. It makes lending more convenient as they don’t have to go to a physical bank. The online lending app uses technology to assess users’ creditworthiness and determine the amount of loan they are eligible for.

7. Insurance App

An insurance app provides users access to insurance services and information through electronic devices like computers, smartphones, and tablets. Insurance companies make these apps and offer a range of features, such as the ability to purchase insurance policies, file claims, view policy details, and track the status of claims.

8. Blockchain-based App

Blockchain is a hot topic and one of the trendiest technologies nowadays. Many companies use blockchain as the underlying infrastructure of an app. A blockchain-based app records transactions on a distributed ledger, which generates copies across a network of computers. Each block in the chain contains a set of commerce, and once a block is in the chain, it cannot be altered or deleted.

What features should your fintech app have?

A fintech app will have many features depending on how the owners want to build it. Some of the standard features include

Secure login and authentication

A fintech app will store millions of data of customers’ sensitive information. Therefore, it requires secure login and authentication to prevent cyberattacks from cybercriminals like two-factor authentication or touch/face ID. Furthermore, fintech apps are necessary to comply with various regulations such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and the Financial Industry Regulatory Authority (FINRA). Secure login and authentication mechanisms help fintech apps meet these compliance requirements.

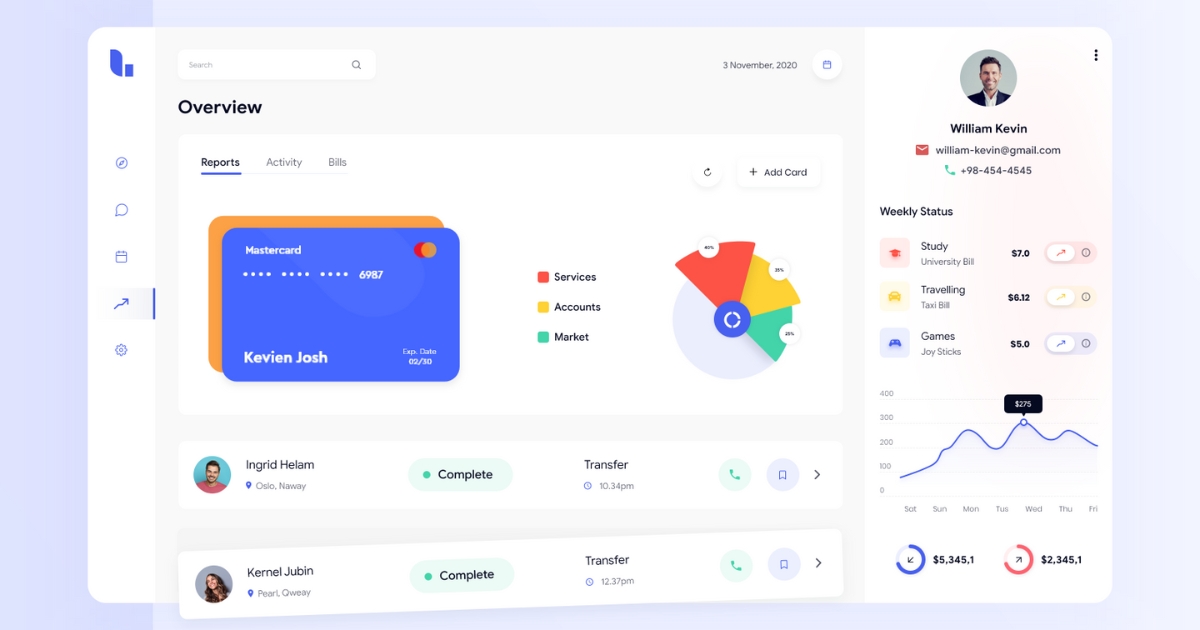

Dashboard

A dashboard is a user interface that helps the user manage their account. It will display the current status of the history and some financial tools and services. A friendly design dashboard is an excellent way to increase user satisfaction when using your app.

Payment integration

Fintech apps should have payment integration with various payment gateways, digital wallets, and other payment options. It will make transactions more accessible and more convenient for users.

Alert and Notifications

Push notifications in fintech apps refer to the messages or alerts sent directly to a user’s mobile device to notify them of important events, updates, or actions related to their financial accounts or transactions.

Customization / Personalization

Fintech apps can provide personalized recommendations based on the user’s financial goals, investment history, and spending habits. It can help users make informed decisions about their finances.

Customer support

How to satisfy customers when they have trouble using your app? Make a customer support feature where you provide the answer to them and give tips and explanations related to your app.

A Comprehensive Guide to Develop Fintech App

Developing a fintech product requires a well-planned strategy to ensure that the product meets the target audience’s needs, is user-friendly, and performs reliably. Here is a step-by-step approach for fintech product development:

Identify the target audience

The first step in developing a fintech product is identifying the target audience. The action involves conducting market research and understanding potential users’ needs, preferences, and pain points.

Define the product concept and features.

The product concept and features

are defined based on the research and insights gathered in Step 1. In this step, you should identify the product’s core functionalities and determine the value proposition that sets it apart from existing products in the market.

Develop a prototype

Once the product concept and features are defined, develop a prototype, a simple wireframe, or a more detailed mock-up that allows you to test the product’s functionality and gather feedback from potential users.

Refine the product based on user feedback

Based on the feedback from potential users, refine the product design and functionality. You may involve changing the user interface, adding or removing features, or modifying the product concept.

Develop the product

Once the product design is complete, it’s time to develop it. It’s time to create the software, backend, and other technical components that comprise the product.

Test the product

Before launching the product, software development must test thoroughly to ensure it functions as intended and is free from bugs or glitches. Testing can be done in-house or through beta testing with a select group of users.

Launch the product

Once the product has been tested and refined, it’s time to launch it. The software team has to make the product available to the target audience through various distribution channels such as app stores, websites, or other platforms.

Provide ongoing support and updates

After launching the product, it’s essential to provide ongoing support and updates to ensure that it meets users’ needs and remains competitive in the market. The work may involve fixing bugs, adding new features, or improving the user interface.

Final thoughts

The banking industry has changed since banks start developing and launching their fintech apps. Developing a fintech app in the banking industry requires technical expertise, user behavior research, sophisticated design, and continuous maintenance. After this article, you will have an overview of how to build an app for your company. If you need help, don’t hesitate to contact TPS Software, with solid knowledge in the Fintech industry.